You make the right calls all day, you deliver your pitches flawlessly, and you donate to every one of your potential client’s kid’s school fundraisers. But you still aren’t closing deals. What gives? Well, you’re clearly screwing something up, and it’s time you find out what it is. It’s frustrating. Day in and day out, you are putting in the work with twelve-hour days and trips across town to meet clients. You study up on your competitors and rehearse your pitches every chance you get. But still, you aren’t anywhere near your sales targets, and your bottom line hasn’t budged since your started. Chances are it’s not about what you’re doing right–it’s about what you’re doing wrong.

How Not to Sell

රු1,465.00

Price Summary

- රු1,465.00

- රු1,465.00

- රු1,465.00

Related Products

The 80/20 Principle

Did you know, for example, that 20 percent of customers account for 80 percent of revenues? That 20 percent of our time accounts for 80 percent of the work we accomplish? The 80/20 principle shows how we can achieve much more with much less effort, time, and resources, simply by identifying and focusing our efforts on the 20 percent that really counts.

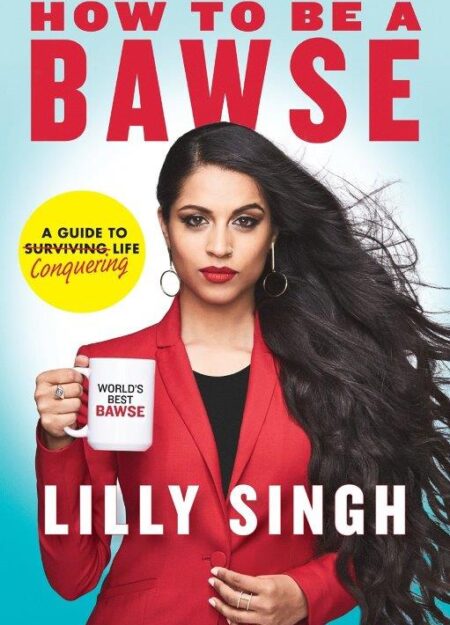

How To Be A Bawse

Lilly singh isn’t just a superstar. She’s superwoman – which is also the name of her wildly popular youtube channel. Funny, smart, and insightful, the actress and comedian covers topics ranging from relationships to career choices to everyday annoyances. It’s no wonder she’s garnered more than a billion views. But lilly didn’t get to the top by being lucky – she had to work for it. Hard.

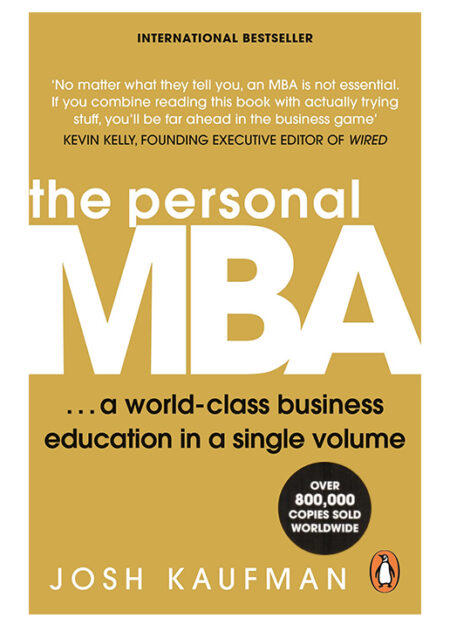

The Personal MBA

An mba at a top school is an enormous investment in time, effort and cold, hard cash. And if you don’t want to work for a consulting firm or an investment bank, the chances are it simply isn’t worth it. Josh kaufman is the rogue professor of modern business education.

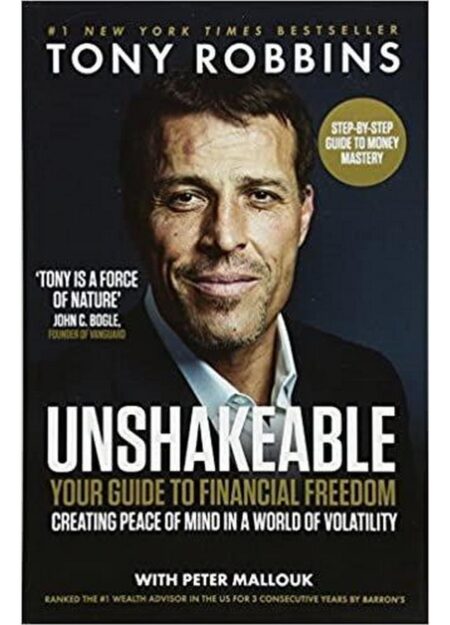

Unshakeable

After interviewing fifty of the world’s greatest financial minds and penning the #1 New York Times bestseller Money: Master the Game, Tony Robbins returns with a step-by-step playbook, taking you on a journey to transform your financial life and accelerate your path to financial freedom. No matter your salary, your stage of life, or when you started, this book will provide the tools to help you achieve your financial goals more rapidly than you ever thought possible.

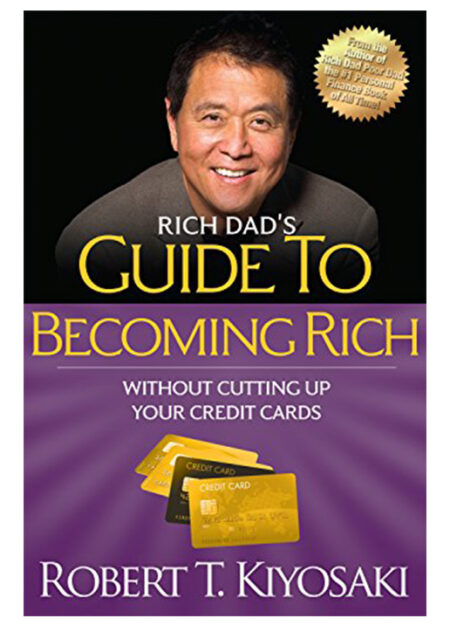

Rich Dad`S Guide to Becoming Rich

There are “financial experts” who advise people to take out their credits cards and cut them up. And that may be a good plan for someone who is financially irresponsible, it’s not great advice for someone who wants to build wealth and become financially free. Cutting up your credit cards won’t make you rich; learning to leverage and manage debt will.

Start With Why

Why are some people and organizations more inventive, pioneering and successful than others? And why are they able to repeat their success again and again? Because in business it doesn’t matter what you do, it matters why you do it. Steve jobs, the wright brothers and martin luther king have one thing in common: they started with why.

Hooked How To Build Habit Forming Products

Nir eyal answers these questions (and many more) with the hook model – a four-step process that, when embedded into products, subtly encourages customer behaviour. Through consecutive “hook cycles,” these products bring people back again and again without depending on costly advertising or aggressive messaging.

Rich Dads Cashflow Quadrant

Are you tired of living paycheck to paycheck? In the sequel to Rich Dad Poor Dad, learn how the role you play in the business world affects your ability to become financially free

Outliers-The Story of Success

Two systems drive the way we think and make choices, kahneman explains: system one is fast, intuitive, and emotional; system two is slower, more deliberative, and more logical. Examining how both systems function within the mind, kahneman exposes the extraordinary capabilities as well as the biases of fast thinking and the pervasive influence of intuitive impressions on our thoughts and our choices.

Rich Dad Poor Dad For Teens

You’re never too young to learn the language of money… And the lessons that rich dad taught robert. Like it or not, money is a part of our everyday lives and the more we understand it, the better the chance that we can learn to have our money work hard for us—instead of working hard for money all our lives.

The Intelligent Investor

This classic text is annotated to update Graham’s timeless wisdom for today’s market conditions…

The greatest investment advisor of the twentieth century, Benjamin Graham, taught and inspired people worldwide. Graham’s philosophy of “value investing” — which shields investors from substantial error and teaches them to develop long-term strategies — has made The Intelligent Investor the stock market bible ever since its original publication in 1949.

Over the years, market developments have proven the wisdom of Graham’s strategies. While preserving the integrity of Graham’s original text, this revised edition includes updated commentary by noted financial journalist Jason Zweig, whose perspective incorporates the realities of today’s market, draws parallels between Graham’s examples and today’s financial headlines, and gives readers a more thorough understanding of how to apply Graham’s principles.

Vital and indispensable, this Harper Business Essentials edition of The Intelligent Investor is the most important book you will ever read on how to reach your financial goals.